One month is officially in the books for 2022, and just as a marathon is never decided by the sprint of the first mile, investors should keep in mind that the market performance over the short term is rarely the final tale of the tape. We do, however, watch and comment on the race as it unfolds. Here are a few take aways from January:

- Anxiety about inflation, as well as impending rate hikes coupled with the tapering of asset purchases by the Fed, led to one of the worst starts to the year for U.S. equities in some time, with the S&P 500 down 5% in January.

- International Developed Markets performance was also generally disappointing.

- Emerging Markets benefited from strong performance in Latin America, while facing headwinds from Ukraine-Russia tensions.

- Commodities markets were driven by gains in the Energy complex (Energy was the only sector in the S&P 500 to post a gain in January, up a staggering 19%) boosted by the continued rise in oil prices.

- S. fixed income performance was weak, especially high yield corporates, as spreads widened.

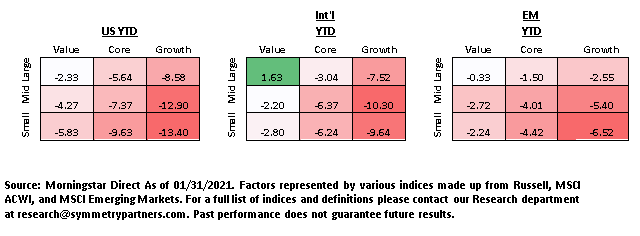

- Across the board, Value strategies held up, with Large Cap Value leading the way.

- Symmetry’s mutual funds, mutual fund models and ETF models benefited from this strong showing by Value.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios. All data is from sources believed to be reliable but cannot be guaranteed or warranted.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the tota