As the economy continues to rebound from the pandemic-related slump, inflation has recently been elevated to the highest rate since 2008, thanks in part to rising demand colliding with supply-chain disruptions and shortages of materials and labor. One item is a poster child for this phenomenon: Cars.

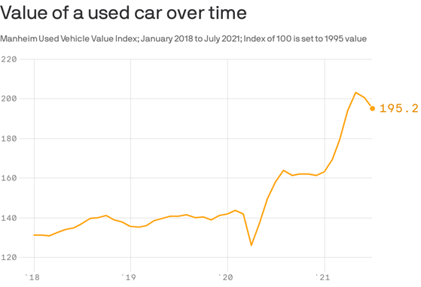

Modern cars need as many as 1,400 different computer chips, and lead times for the manufacture of such chips can be as long as 180 days. Protracted supply chain issues have caused a shortage of these chips, which in turn has caused a shortage of new cars. As a result, demand boomed for used cars, driving their prices through the sun-roof!

The Consumer Price Index (CPI) measures what consumers pay for goods and services, and is one of the primary ways we measure inflation. The rapid change in price of used cars and trucks has been responsible for one-third of the increase in the CPI in May and June.

The Federal Reserve is betting that elevated inflation readings will be temporary and mainly due to supply-chain bottlenecks and other effects of reopening the economy, and should cool over time as those temporary issues get resolved. July’s CPI measurement suggests they may be right, as the index for used cars and trucks significantly decelerated from the heightened levels of May and June.

This shows that one really needs to look under the hood on a current round of inflation—and understand that instead of some general phenomena, it is largely driven by idiosyncratic factors that should abate over time. So while we may not be able to park all our inflation concerns, we can certainly put them in Neutral.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.