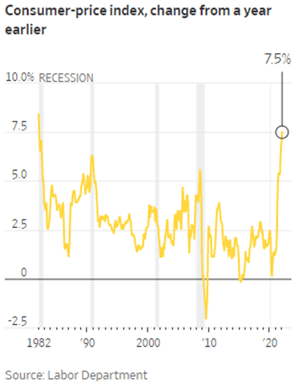

According to the Bureau of Labor Statistics, The US consumer price index (or CPI) rose 7.5% in January when compared with January 2021, its fastest annual pace since 1982. The CPI measures the average change in prices paid by consumers for a typical basket of goods and services, and while there is some critique on how well it measures inflation, it is often used as an inflationary indicator reflecting the general level of prices changes across the economy. Driving the increase when compared to January a year ago are used-car prices (up 40.5%), gasoline (up 40%), food prices (up 7%), and we continue to see a steady pickup in rental costs, which account for nearly one-third of the CPI.

Much of the increase is seemingly fueled by pandemic-related supply-and-demand imbalances, which economists expect to fade as the pandemic recedes and we get back to a more “normal” environment (when and how that materializes is anyone’s guess).

High inflation is usually driven by a strong economic growth, posing a challenge to the Federal Reserve as it tries to curtail rising prices without damping a rebounding economy, and market participants will be watching with keen interest in the months ahead as the Fed tries to determine the appropriate tempo and scale of rate increases entering a tightening cycle.

Investors should be prepared for markets to experience higher volatility over the short-term, however, it’s helpful for long-term investors to keep in mind that over time markets have rewarded investors across inflationary/deflationary environments, rising rate/falling rate cycles, and periods of economic growth/recessions.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.