-5.png)

Market Commentary: January 2023

Big Picture

Markets are off to a roaring start this year. The rally in tech stocks has powered the NASDAQ to one of its best Januarys since its inception. This bullish enthusiasm has largely been animated by a slate of positive economic data, fueling the belief that the Federal Reserve will pivot away from raising interest rates. The Fed, ECB, and Bank of England all announce rate decisions to kick off the next month, and any sign of hawkishness could be a catalyst for volatility.

Equities

In an abrupt U-turn from 2022, equities have strongly rallied for much of the month.

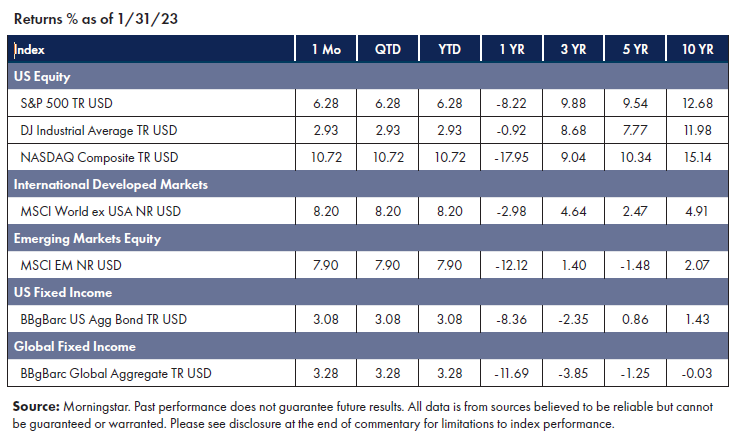

• U.S. markets, led by technology stocks, finished the month up.

• International developed stocks were lifted by the same macro forces and ended the month up.

• Emerging Market stocks performed in a similar fashion, ending the month up.1

Fixed Income

Bonds have benefited from a drop in yields as cooler inflation data has eased market pressures.

•The Bloomberg US Aggregate Bond Index, or the “Agg,” finished positive on the month.

•The Bloomberg Barclays Global Aggregate Index, representing bonds from both developed and emerging markets, also ended up for the month.2

Factors

Risk factors have been a mixed bag for the month as risk assets, in general, have done well. Small-cap stocks, in particular, have had a good start to the year. In the US, the size factor has been a positive contributor. While International Developed and Emerging Markets, market beta has led the way, with the Value factor closely behind.3

NEWS Impacting Markets

Inflation

The U.S. Bureau of Labor Statistics released December’s Consumer Price Index (CPI) report, which showed inflation easing for a sixth straight month, dropping to 6.5% from November’s 7.1% number. The fall in energy prices, shipping costs, and used vehicles all point to a possibility that the Fed was right in the assessment that much of the inflationary pressure in core goods was transitory (good news), but the ongoing rise in core services prices suggests that they may also be right to continue a vigilant posture. The CPI report suggests inflation is slowing, which should cause the Fed and other central banks to dial back the pace of rate increases, but until inflationary data is back down towards the Fed’s target of 2%, expect them to maintain rates at elevated levels.

Jobs

The Labor Department’s December jobs report showed the U.S. economy added 223,000 jobs in December, which exceeded expectations while demonstrating a slowdown from 256,000 jobs in November. It also showed a decline in the pace of wage growth. Meanwhile, technology companies, including Amazon, Microsoft, and Alphabet, have been leading the way when it comes to layoffs, cutting over 50,000 jobs so far this year. Much of this is undoing some of the massive hirings they did in 2022 (most of these companies are still net positive on headcount from last year). However, cuts by Hasbro, Dow, and 3M, along with a pullback in temp employment, suggest that softening labor demand may be spilling over into the broader economy. Thus far, it’s tough to tell if we are seeing an early indicator of economic slowdown or the undoing of an overshoot in hiring post-pandemic.

China

After three long years, in an about-face, the Chinese scrapped their “zero-COVID” policy and have quickly reopened their society. The abrupt reopening has sparked a significant increase in infections, impacting labor shortages and supply chains. This is challenging expectations for the growth rate in China to expand as the economy opens up and could delay the anticipated impact on the broader global economy, other emerging markets, and commodities markets (especially oil) for the first part of the year.

Final Thoughts

The US economy is cooling, but growth hasn’t stalled (fueling hopes for a “soft landing”). The latest data makes it likely that the Fed will downshift the size of its interest rate hikes in the near future. However, fears of recession will continue to haunt markets until the data is conclusive enough for the Fed to halt rate increases altogether (and perhaps even back them off a bit). However, markets may be getting ahead of themselves, as it’s likely to be a longer slog than investors are currently pricing in. If so, the hot start to the year may run headlong into a “wall of worry” at some point, which could make for a bumpy ride over the short term.

However, in the long run, markets are efficient at pricing in new economic developments and news, then quick to resume rewarding investors who patiently put capital work and reap the returns over time.

1 Morningstar Direct, as of Jan 31, 2023

2 Morningstar Direct, as of Jan 31, 2023

3 Morningstar Direct, as of Jan 31, 2023

Symmetry Partners, LLC, is an investment advisory firm registered with the Securities and Exchange Commission (SEC).

The firm only transacts business in states where it is properly registered, or excluded or exempt from registration requirements. Registration with the SEC or any state securities authority does not imply a certain level of skill or training. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non- investment related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. Please note the material is provided for educational and background use only. Moreover, you should not assume that any discussion or information contained in this material serves as the receipt of, or as a substitute for, personalized investment advice. Diversification seeks to improve performance by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market. Past performance does not guarantee future results.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization. Dow Jones Industrial Average (DJIA) Is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The Nasdaq Composite Index (NASDAQ) measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market, and includes over 2,500 companies. MSCI World Ex USA GR USD Index captures large and mid cap representation across 22 of 23 developed markets countries, excluding the US. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets (as defined by MSCI). The index consists of the 25 emerging market country indexes. Bloomberg Barclays US Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States – including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Bloomberg Barclays Global Aggregate (USD Hedged) Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers. Index is USD hedged.

© Morningstar 2023. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.