How to Solve Your Technology Challenges

One of the biggest challenges Financial Advisors face when it comes to incorporating technology solutions into their practices is not having sufficient time to learn and implement the solutions.[1] It’s akin to someone who says they could lose weight and get healthier IF ONLY they had enough time to do it.

And finding the right tech solutions is increasingly important as new and valuable tools—that can help you scale your advice and achieve new efficiencies in your practice—are introduced almost daily.

Once you are stuck in the mindset that something is just too large of a task, it becomes daunting, and you may end up not accomplishing goals that could lead to better outcomes. Having a plan of action and breaking down your ultimate aim into smaller steps can be helpful to getting you where you want to be.

We may not be able to help you fit back into the jeans you still have from college, but we can help guide you to ways to improve your business by choosing technology tools that are the right fit for you and get on track to running your practice like a lean, mean, client-growing machine. This is something Symmetry has been doing for financial advisors for almost three decades.

Here are some things to keep in mind:

- How many software programs and tools are you using?

- What are the functions of these programs and tools? Do they work as expected?

- Are there any gaps?

- Are there tasks you are doing manually that could be automated?

- What are your short-term and long-term goals for incorporating technology solutions?

- Which solutions are worth your time and effort to learn and which are better outsourced?

Let’s start with that first point. Drafting a simple list of just WHAT you’re using is a great place to begin. Jot down any software you’re using, including subscription services you signed up for three years ago and forgot all about (we all have one or two!). Check for any gaps or redundancies you might have with these services. You may find you have too few or too many tools. If you're finding you have too few, be sure not to overdo it by signing up for the hottest new service promising to make your life easier.

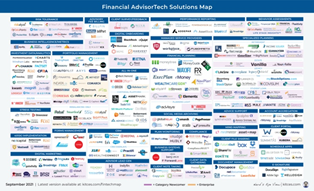

You will need to do some research and investigate what these services offer and how they can benefit you and your clients. This can be an intimidating undertaking, given the sea of options out there. Just take a look at this Tech Solutions Map from Kitces:

It’s enough to make your pulse skyrocket. It’s OK. Take a deep breath, and cool down. Really give thought to what types of services will get you to your goals. Which are…

Well, what are they? Streamlining processes and communications for your clients is a good one. Freeing up your time by using automated services can be another. Making it easier for you to connect with your clients and vice versa through video chats, virtual events, and digital resources is one more. Use your core strength and think about what you really need.

And once you know exactly what you hope to achieve, you can then decide which options are worth putting your time into to learning yourself and which you are better off outsourcing to a partner like Symmetry.

For example, it may be helpful for you to learn how to create engaging social media posts to promote your practice, but designing emails or creating ongoing digital communications may be tasks you could leave to a more experienced party. Symmetry Partners offers a number of resources with engaging content for you and for your clients.

By taking some time to find out which technology solutions are right for your practice, you may end up realizing you don’t need to spend as much time as you thought to try to free up more of your time! And then you can trade in that stopwatch for a Fitbit and start getting more fit.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

[1] Cerulli Advisor Metrics 2020