-5.png)

Market Commentary: Q4 2023

Quarter In Review

Markets shook off one of the worst October performances in years to finish with a flurry in the last few months of 2023.

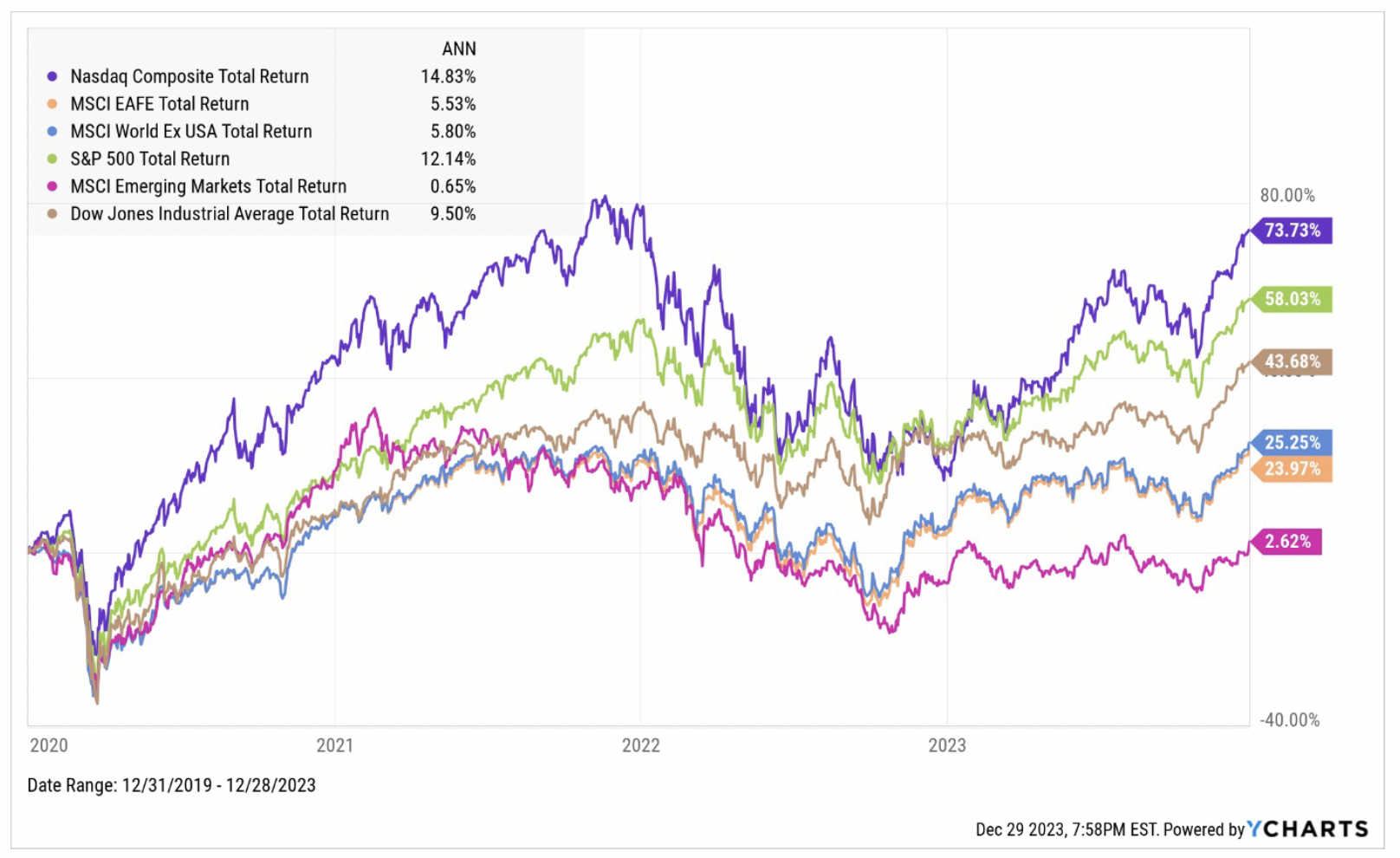

The “everything rally” at year-end culminated with the S&P 500 finishing the year with an impressive 24% gain, coming oh-so-close to its record high from January 2022. The Dow Jones Industrial Average climbed 14% and surpassed 37,000 for the first time while scoring seven new closing records in the final days of 2023. Meanwhile, the NASDAQ Composite experienced a phenomenal ride fueled by the excitement surrounding artificial intelligence and big technology stocks, skyrocketing up 43% for the year.1

Bond markets also participated in the rally, posting one of the best two months on record. The Bloomberg Global Aggregate Total Return Index has seen an impressive rise of nearly 10% over November and December, marking its strongest two-month performance since data collection began in 1990.

Yields on 10-year U.S. Treasuries, a widely recognized global borrowing benchmark, have significantly declined by over 110 basis points since their peak of 5.019% in October to finish the year at 3.87%. Furthermore, investment-grade corporate bonds have experienced a remarkable rally, delivering a return of almost 11% since the start of November and heading toward the best two-month gain on record, according to a Bloomberg Index dating back to 2001.2

The year-end rally has been dramatically influenced by the excitement and confidence of market participants, relieved by the absence of a recession that had worried many throughout 2023, the ongoing strength of consumer spending bolstering a remarkably resilient U.S. economy, and declining inflationary pressures leading to changes in interest-rate expectations for 2024, prompted by the Federal Reserve’s suggestion of possible rate cuts during its last meeting of the year.

What's Been Driving Markets

The Economy, Inflation & the Fed

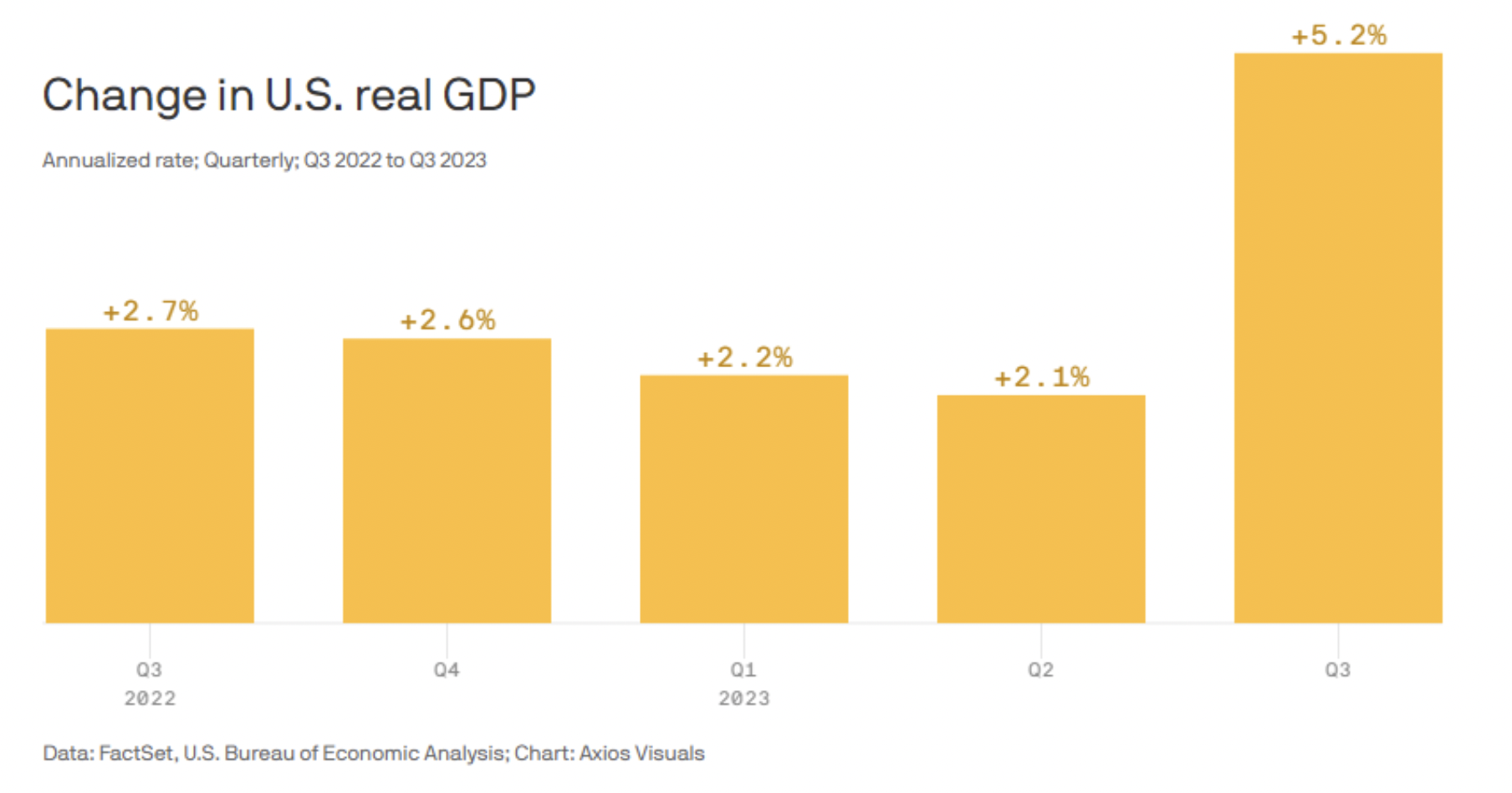

The U.S. economy showed steady growth in 2023. It expanded at an average annualized rate of 3.2% in the first three quarters, and another 1.3% is projected for Q4. In November, inflation decreased to 3.1%.

The job growth rate in the United States exceeded expectations, while unemployment dropped lower than anticipated. According to the U.S. Bureau of Labor Statistics, total nonfarm payrolls increased by 199,000 last month, surpassing the consensus survey, which predicted a gain of 185,000.

The ongoing robust job market and decelerating inflationary pressures have market participants feeling optimistic about a “soft landing” without a recession as we roll into 2024.

Vibecession

In early December, Dictionary.com introduced a new word to its lexicon: “vibecession.” The term refers to a period when people feel generally pessimistic about the economy, regardless of its actual state.

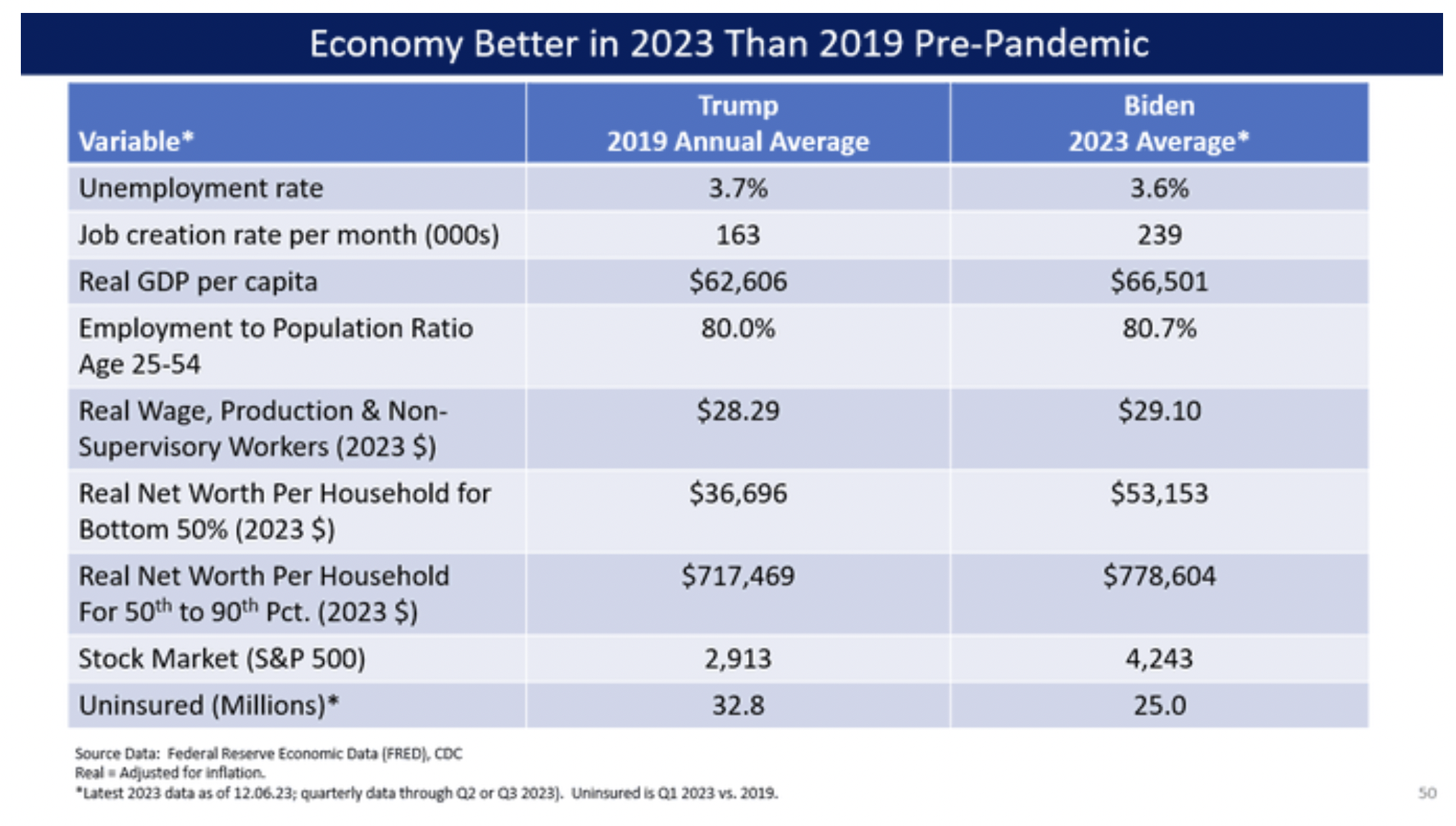

Despite the economy doing relatively well based on financial data and statistics (back to or exceeding pre-pandemic levels), the public feels pessimistic about the current or future economic situation. While the terminology is new, the disconnect between people’s perceptions and objective economic indicators is well documented across time.

Research has shown that Americans consistently overestimate the negative aspects of various economic measures. By significant margins, they believe that inflation continues to rise (while it is actually falling), that it has outpaced wage growth (when wages have actually outpaced prices), and that they have become less wealthy (even though they have become significantly wealthier).

Overall, the concept of vibecession sheds light on the disconnect between people’s perceptions and objective economic indicators. While it seems to have had little to no effect on consumer spending or markets thus far, it bears watching as a potential source of shifting investor sentiment and volatility during a contentious political season in 2024.

Final Thoughts

The past four years have been a rollercoaster ride for markets as the world has reacted to a pandemic, inflationary aftershocks, wars in Europe and the Middle East, and historic central bank activity.

The subsequent volatile swings have left investors, at times, feeling both euphoric and depressed. This isn’t irrational. It’s an observable phenomenon across time. As humans, we’re prone to focus on what is happening at the moment and place a good deal of weight on the importance of recent events.

2023 has been a good year for investors. 2024 may not be as good. Or it may be better.

Like a rollercoaster, trying to time the ups and downs of the ride and getting off while it’s in motion is how you get hurt. The best action is to stay on the ride until you reach the final destination.

Enjoy the highs, endure the lows, and focus on your long-term goals.

1 Banerji, G., “What Did Wall Street Get Right About Markets This Year? Not Much,” Wall Street Journal, December 29, 2023. https://www.wsj.com/finance/stocks/ what-did-wall-street-get-right-about-markets-this-year-not-much-7d4368fe

2 Carson, R. & Kondo, M., “Global Bond ‘Carnival’ Sets Stage For Record Two Months,” Bloomberg.com, December 28, 2023. https://www.bloomberg.com/news/ articles/2023-12-28/global-bonds-eye-biggest-ever-two-month-gain-amid-rate-cut-bets

The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration with the SEC or any state securities authority does not imply a certain level of skill or training. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. Please note the material is provided for educational and background use only. Moreover, you should not assume that any discussion or information contained in this material serves as the receipt of, or as a substitute for, personalized investment advice. Diversification seeks to improve performance by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market. Past performance does not guarantee future results.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization. Dow Jones Industrial Average (DJIA) Is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The Nasdaq Composite Index (NASDAQ) measures all Nasdaq domestic and international based common-type stocks listed on The Nasdaq Stock Market and includes over 2,500 companies. MSCI World Ex USA GR USD Index captures large and mid-cap representation across 22 of 23 developed markets countries, excluding the U.S. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets (as defined by MSCI). The index consists of the 25 emerging market country indexes. Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed-income securities in the United States—including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Bloomberg Global Aggregate (USD Hedged) Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers. Index is USD hedged. Stock returns represented by Fama/French Total U.S. Market Research Index, provided by Ken French and available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. This value-weighed U.S. market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted U.S. market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

© Morningstar 2023. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted, or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.