Morningstar's Star Ratings Are a Poor Way to Pick Investments

Since the early 1990’s mutual funds have been the primary investment vehicle of choice for millions of investors, many of whom have come to rely on data, services, or ratings from Morningstar Inc. to help them decide which investments are the most appropriate.

Before the launch of Morningstar, it was difficult for everyday investors to get enough information about various funds to make apples-to-apples comparisons. Credit is due to the firm for significantly improving the transparency and ease of use for individual investors to review mutual funds’ holdings and performance data. However, over time, many investors and financial advisors gravitated to one critical rating to determine how to pick a mutual fund – the number of stars awarded to it.

Morningstar has used its star rating system for decades to rate mutual funds, with “five stars” being assigned to the top 10% of funds, measured by performance based on an average of risk-adjusted returns over three-, five-, and ten-year periods. Many investors mistakenly took Morningstar’s star ratings to imply that funds that performed well in the past would do so in the future, and funds that earned high star ratings were rewarded by attracting the most investor dollars.

Unfortunately for those investors, most of the five-star funds failed to maintain their previous level of performance or outperform their benchmark index over time.

In a recent audit of their rating system, Morningstar found that 71% of five-star funds no longer held that rating five years later. In fact, over all the measured periods—three, five, and ten years—five-star funds were more likely to turn in three-star performance or worse.

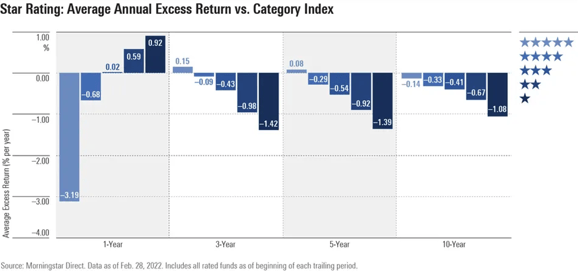

The same study also found that none of the star-rated cohorts could generate better average annual returns versus their assigned indexes (see chart below).

Source: https://www.morningstar.com/articles/1097971/rating-morningstars-fund-ratings All data is from sources believed to be reliable but cannot be guaranteed or warranted.

Data is selected based on recent study by Morningstar and may not be the most current data available.

Morningstar also found that during the bear market in February of 2022, more stars equated with worse performance: five-star funds fell 3.19% below their benchmarks in the past year. While, almost paradoxically, one-star funds beat their benchmarks by 0.92%.

The Wall Street Journal has previously found that "most five-star funds perform somewhat better than lower-rated ones, yet on average, five-star funds eventually turn into merely ordinary performers." Morningstar itself cautions that “a high rating alone is not a sufficient basis for investment decisions.” Over time, Morningstar has rolled out other methods of rating that attempt to circumnavigate the problems associated with a system reliant on purely backward-looking methodology, but each has its pros and cons.

Investors (and their advisors) would do well to recognize that Morningstar provides a somewhat useful service but selecting the most appropriate investment involves much more nuance than any rating system can express. Putting a collection of five star funds in your portfolio not only won’t guarantee outstanding performance, it may not match your comfort with risk, and may not be properly allocated around the world. Taking a more thoughtful approach of selecting investments that add to a diversified portfolio built to suit your risk preferences and unique situation, is a much more sensible path.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission (SEC). The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.