.png)

The Critical Role of a Financial Advisor

Why do some investors choose to “go it alone;” to navigate the world of investing based on their own observations, information, or feelings? Maybe they believe that investing is easy or that making their own investment decisions is more cost efficient?

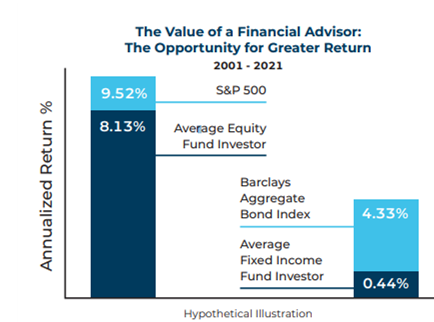

According to a study by DALBAR Inc., over the period 2001 – 2021, the average equity fund investor received an annualized return that substantially lagged the return of the S&P 500. Fixed Income fund investors did even worse—in an asset class that is supposed to be generally less risky than stocks.

Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Please see disclosure on the next page for limitations to the performance information.*

Why?

- Many investors sell underperforming investments and replace them with others that are performing well; AKA “buying high” and “selling low”

- Emotionally-driven decisions can cause trading at inopportune times

- Investment activity motivated by media hype or so-called “experts”

- Poor market timing decisions resulting in missed opportunities

A Financial Advisor Can Help While investment returns are unpredictable, a financial advisor can help you stay focused on your investment objectives and committed to your long-term plan. An experienced advisor will help you to define your goals and implement a strategy designed to potentially increase your returns over time.

Your financial advisor can assist you in:

- Creating a long-term financial plan to achieve what is important to you personally and financially

- Constructing a suitable portfolio to help get you there

- Monitoring your progress toward achieving your goals

- Making sure your plan and portfolio keep pace with changes in your life or circumstances

Symmetry has put together a piece that Financial Advisors can use to illustrate this with their clients. Click here to learn more!

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

*Source: “Quantitative Analysis of Investor Behavior, 2022” DALBAR, Inc. www.dalbar.com

Equity benchmark performance and systematic equity investing examples are represented by the Standard & Poor’s 500 Composite Index, an unmanaged index of 500 common stocks generally considered representative of the U.S. stock market. Indexes do not take into account the fees and expenses associated with investing, and individuals cannot invest directly in any index. Past performance cannot guarantee of future results.

Bond benchmark performance are represented by the Bloomberg Barclays Aggregate Bond Index, an unmanaged index of bonds generally considered representative of the bond market.

Average equity and average bond investor performance results are calculated using data supplied by the Investment Company Institute. DALBAR is an independent, Boston-based financial research firm. Investor returns are represented by the change in total mutual fund assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions and exchanges for each period.

Indices are unmanaged. Investors cannot directly invest in an index. Indexes have no fees. Historical performance results for indexes generally do not reflect the deduction of transaction and/or custodial