-6.png)

The Value of a Financial Advisor in the Age of AI

Hardly a day goes by without new artificial intelligence technology advances making the news. It has drastically changed how we experience art, music, and entertainment. From Netflix's recommendation engine to Spotify’s personalized playlists generated through deep learning techniques, it’s evident that machine intelligence plays a significant role in our daily lives, from what media content we consume to how much of it.

Each day brings us closer to understanding how far this cutting-edge technology will bring us into an exciting age of rapidly transforming experiences created by AI.

Financial services are one area undergoing transformation, with the rise of operational automation and algorithmic trading. This might lead you to wonder about the value of a human financial advisor—after all, modern technology is more than proficient at generating a risk questionnaire, plotting specific financial goals on a timeline, and developing a recommended “optimal” portfolio mix.

So, why bother working with a human? Working with an experienced financial advisor has several advantages over relying on technological solutions alone. This blog post will discuss why having that human touch is (and will continue to be) important when investing.

The Impact of AI on Investing

As AI continues its rapid development, its impact on investing becomes more pronounced. The ability of algorithms to analyze vast amounts of data, recognize patterns, and make predictions has the potential to revolutionize the investment world. However, it’s essential to understand AI’s strengths and limitations in this field.

While it can identify opportunities and minimize risk, it can’t replace the human element of intuition and creativity. As markets become increasingly technologically driven, AI can provide valuable operational and trading tools, drive costs down, and make investing more accessible and convenient. Still, it’s important to approach it with a balance of optimism and a healthy dose of skepticism.

Identifying the Benefits of Using a Financial Advisor

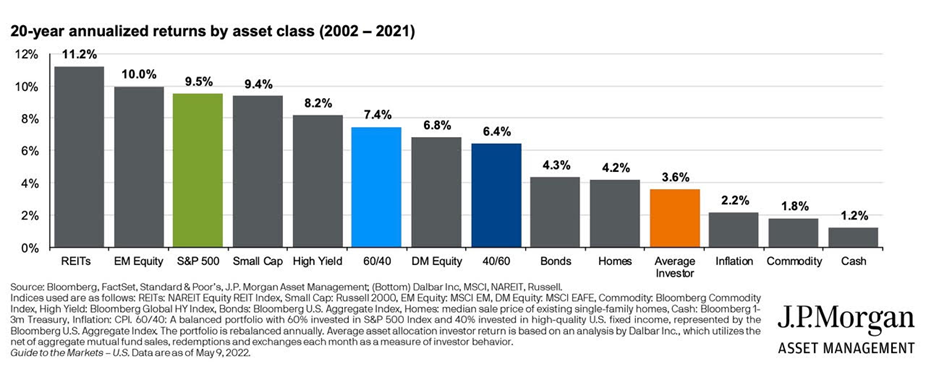

Organizations like Morningstar, Vanguard, and Envestnet have been researching "advisor value" for several decades. While their methodologies are slightly different, each has consistently found that financial advisors can significantly improve investor outcomes and contribute up to 4% in average annual investment gains above what the average investor would realize on their own.

These benefits come from being able to tailor financial strategies (such as dynamic withdrawal, tax efficiency, and liability matching) to an investor’s unique situation based on an in-depth awareness of hopes, fears, goals, preferences, and personal tastes.

AI could become sufficiently nuanced to incorporate more of these things in time. However, the research has shown that the most valuable component of working with a financial advisor comes from behavioral coaching.

Behavioral Coaching and the Role of an Advisor When Markets Are Volatile

Since the late 1970s, a branch of research known as Behavioral Economics has changed our understanding of how psychological, cognitive, emotional, cultural, and social factors impact the financial decisions of individuals. It turns out that the human brain processes information in a way that causes us, at times, to act in ways that aren’t conducive to successful financial outcomes. According to market research firm Dalbar, this is one of the main reasons why the average investor consistently underperforms the market over time.

Source: JPMorgan Asset Management

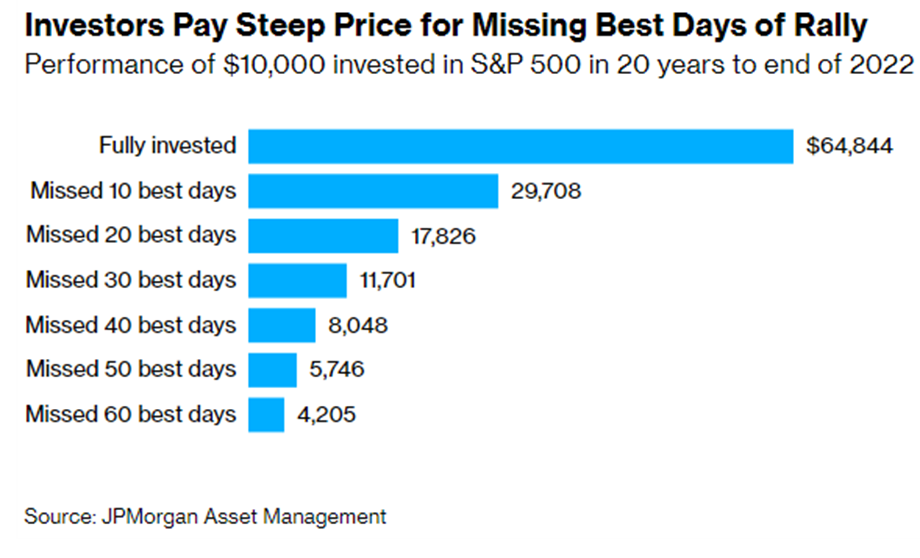

A great example of this can be seen during last year’s down market. A survey by Ernst & Young found that between a quarter to nearly half of the investors fled the market and went to cash amid the market volatility (made all the easier by automated trading tools). Half of the S&P 500’s best days over the past 20 years have occurred during such markets. Miss just a few of those, and the negative impact on long-term returns can be significant.

As shown in the chart below, the best 10 days over the past 20 years accounted for over half of the overall return for the period! Working with a dispassionate third party, like a financial advisor who can help keep you from making the wrong move at the wrong time in response to volatility, can make a huge difference.

Tips for Finding the Right Financial Advisor for You

Getting the right advice at a critical moment can make an enormous difference. So, how do you find the person to provide that advice? Here are a few tips to consider:

- Interview several prospective advisors and make sure there is good chemistry and personal connection. After all, you want to know that when doomsday headlines dominate the media, and you’re scared and uncertain about what to do, a trusted voice will pick up the other end of the line to help soothe your frayed nerves.

- Credentials and experience matter. Ensure you’re working with someone committed to mastering a relevant body of knowledge and consistently pursuing ongoing education in the field (standard requirements for credentials such as a CFP, CIMA, CFA, etc.) and has extensive experience coaching clients through different types of markets.

- Make sure you understand their fiduciary obligation and how they get paid. A fiduciary has an ethical obligation to put your interests first, especially when avoiding any conflicts of interest in how they get paid. Trust begins with complete transparency.

Looking for more tips? Read 7 Steps To Choose The Right Financial Advisor.

Bottom Line

AI and automation are great tools for making financial investing more efficient. With AI, it’s possible to have access to recommendations that can save time and increase returns over long-term investments.

However, having someone who can offer an emotional component to your strategies, guidance, and understanding of investor behavior is critical to developing an optimum long-term investment plan. So, if you’ve found that person, great, stick with them!

On the other hand, if you're looking for assistance managing your money efficiently and effectively, we encourage you to research and find the right advisor who can cater specifically to your needs. Having that human touch is essential when investing—so go out there and find the best fit for you.