The Ramifications of Russia’s Invasion of Ukraine

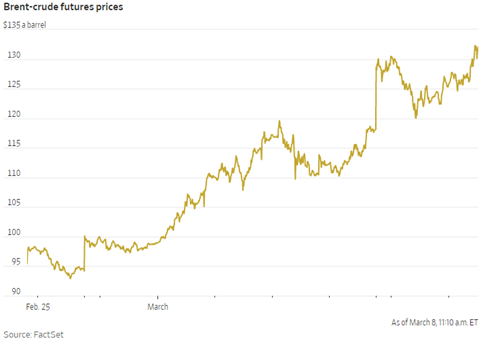

Since the active invasion of Ukraine by Russian forces, the U.S. and its allies have responded with unprecedented levels of financial sanctions against Russia. However, to date they have largely avoided specifically targeting the country’s oil exports out of fear it could cause crude prices to spike globally.

According to U.S. Energy Information Administration, Russia is the world’s third-largest oil producer, responsible for more than 10% of global supply…fears that ripping that supply out of the global market could cause collateral damage, making these sanctions a last resort.

That changed on Tuesday morning (3/8) as President Biden announced the U.S. will institute a ban on imports of Russian oil and natural gas.

- The move has been matched by the UK, but many of the U.S.’s European allies won’t be able to, at least immediately.

- While Russian oil makes up a small proportion of the crude that the U.S. imports, Europe is a different story. Germany is dependent on Russia for imports of more than 55 per cent of its gas, half of its coal and 35 per cent of its oil.

- Prices for oil and natural gas have soared, with crude futures approaching $140 a barrel.

Prior to the eruption of hostilities, inflation (and associated central bank policy responses) were among investors primary macroeconomic concerns (along of course with recovery from a global pandemic). Energy has been a significant contributor to the recent spike in inflation, and higher prices in this sector will continue to add upward pressure to prices in general.

The same is true for commodity markets, which have also been dramatically impacted.

- Wheat - Russia produces 11% of the world’s wheat and is the largest exporter. Coupled with Ukraine, the two countries represent more than a quarter of the world’s supply. With supply from both now severely impacted, wheat prices shot to a record $12.94 per bushel, up 70% over the last month

- Nickel – a central ingredient in stainless steel and rechargeable batteries for electric vehicles. Russia is the third largest producer globally. Prices roughly doubled to unprecedented highs.

- Palladium – a key metal used in catalytic converters that automakers install to scrub engine emissions. Russia is the world's largest producer responsible for 40% of global output. It's up roughly 40%.

- Aluminum – a lightweight metal that is vital to industries across the economy from consumer packaging to aerospace and defense and construction. One of the world’s largest producers is an oligarch linked Russian company. Up more than 30%.

- Neon Gas – a crucial component in semiconductor production. Ukraine produces about 70% of the world’s neon gas exports. Two-thirds of it comes from a single factory in Odesa, Ukraine. Prices have quadrupled year to date.

Bottom Line

- Expect to see higher prices and shortages for all kinds of products in the short-term. A pandemic-induced surge in demand for goods, coupled with labor shortages, have stressed supply chains to the point there is no slack in the system. Disruptions in remote corners will have outsized ripple effects on the whole supply chain.

- Expect market volatility to continue as prices absorb and reflect the rapidly changing news. Markets are dealing with a tremendous amount of uncertainty, driven by headlines that are arriving minute by minute.

Amidst the ever-changing geopolitical landscape and a return of volatility to global markets, Symmetry Partners believes investors are best served by taking a long-term approach to investing and avoiding making investment decisions based on the discomfort caused by short-term gyrations.

While this approach can become more difficult during periods of market volatility, history has shown us it is more often than not the most prudent course of action.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.