What Are Investment “Factors” & Why Should I Care?

Up until the 1990s there were essentially three main philosophies for building investment portfolios:

- Invest for Growth

- Invest for Income

- Invest for Growth & Income.

But something happened in the early 90s which unleashed a massive change.

The 90’s witnessed an explosion in new types of investment vehicles that were differentiated by investment style—growth, value, or a blend of the two—and by market capitalization of the underlying companies—small-, mid-, and large-capitalization stocks. The Morningstar “nine-style” box was born, and investors embraced the ability to increase diversification across domestic and international equites in ways not previously available.

Source: Morningstar

Source: Morningstar

What happened?

In 1993 Eugene Fama and Kenneth French published a paper in which they examined the body of evidence from over thirty years of academic research looking at where returns for investments actually come from. They identified three leading causes or “factors” that helped to explain a good deal:

- Market factor(driving the rewards that investors realize from simply choosing equities over a basket of US Treasury bonds)

- Size factor(driving the rewards over time for investing in smaller-cap companies)

- Value factor(driving the rewards for buying cheaper stocks relative to more expensive stocks over time)

Fama and French provided empirical evidence that this multi-factor model is a better representation of stock returns than previous models. Over time, other factors, such as momentum, volatility, quality, liquidity and yield have been examined empirically and successfully used by investors.

Source: MSCI

Source: MSCI

Simply put, factors are characteristics of stocks or bonds that have been identified by extensive research as offering the potential for:

- Higher returns over time*

- Reduced risk*

Just as healthy diets depend on the right nutrients…portfolio returns depend largely on the right factors.

* Please be advised that adding these factors may not ensure increased return over a market-weighted investment and may lead to underperformance relative to the benchmark over the investor’s time horizon. Information regarding these factors can be found on the back page.

Why should I care about any of this?

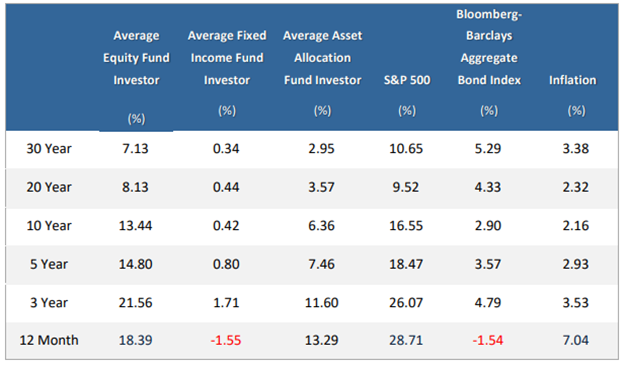

DALBAR, a widely renowned independent research firm, has repeatedly found over a wide variety of time frames that the average investor earns less—in many cases much less—than a passive benchmark of the market (both equity and fixed income).

For the period ending 12/31/2021

Source: DALBAR 2022 Quantitative Analysis of Investor Behavior. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Please see important disclosure at the end of this article for limitations to the performance information.

Source: DALBAR 2022 Quantitative Analysis of Investor Behavior. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Please see important disclosure at the end of this article for limitations to the performance information.

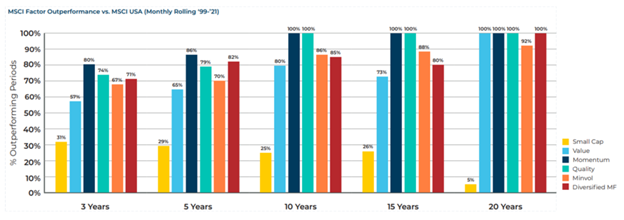

Juxtapose the average investor experience to the performance of factor exposures over time (below), and you see a rather stark divergence vs a passive benchmark of the market over time.

Factors Over Time

Source: Morningstar. As of 1/11999-12/31/2021. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Please see important disclosure at the end of this article for limitations to the performance information.

Source: Morningstar. As of 1/11999-12/31/2021. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot be guaranteed or warranted. Please see important disclosure at the end of this article for limitations to the performance information.

Material is intended for financial professionals only.

Note also, that while factors tend to outperform the market over time, they do not move in lock step and will outperform—and even under perform—at different times. This is why we believe that factor diversification is just as important as asset class diversification for a better long-term investment experience.

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission (SEC). The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

* Symmetry Partners’ investment approach seeks enhanced returns by overweighting assets that exhibit characteristics that tend to be in accordance with one or more “factors” identified in academic research as historically associated with higher returns. Please be advised that adding these factors may not ensure increased return over a market weighted investment and may lead to underperformance relative to the benchmark over the investor’s time horizon. Currently, the major factors in equity markets used by Symmetry and some associated academic research are: the market risk premium (Sharpe, William F. “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk.” The Journal of Finance, Vol. 19, No. 3 (Sept. 1964), 425-442.), value (Fama, Eugene and Ken French. “Common risk factors in the returns on stocks and bonds.” Journal of Financial Economics, 33, (1993), 3-56.), small (Banz, Rolf W. “The Relationship Between Return and Market Value of Common Stocks.” Journal of Financial Economics, 9 (1981), 3-18.), profitability (Novy-Marx, Robert. “The Other Side of Value: The Gross Profitability Premium.” Journal of Financial Economics, 108(1), (2013), 1-28. ), quality (Asness, Clifford S.; Andrea Frazzini; and Lasse H. Pedersen. “Quality Minus Junk.” Working Paper.), momentum (Jegadeesh,Narasimhan and Sheridan Titman. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” The Journal of Finance, Vol. 48, No. 1, (March 1993), 65-91), and minimum volatility (Ang, Andrew,Robert J. Hodrick, Yuhang Xing and Xiaoyan Zhang. “The Cross-Section of Volatility and Expected Returns.” The Journal of Finance, Vol. 61, No. 1 (Feb. 2006), pp. 259-299.) On the bondside, Symmetry primarily seeks to capture maturity and credit risk premiums (Ilmanen, Antti. Expected Returns: An Investor’s Guide to Harvesting Market Rewards. WileyFinance, 2011, p157-158 and 183-185.).

Factors Over Time Disclosure

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

Value = MSCI USA Value Index: MSCI USA Value Index captures large and mid-cap US securities exhibiting overall value style characteristics. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. With 322 constituents, the index targets 50% coverage of the free float-adjusted market capitalization of the MSCI USA Index.

Quality = MSCI USA Quality Index: MSCI USA Quality Index is based on the MSCI USA Index, its parent index, which includes large and mid-cap stocks in the US equity market. The index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage.

Momentum = MSCI USA Momentum Index: MSCI USA Momentum Index is based on MSCI USA Index, its parent index, which captures large and mid-cap stocks of the US market. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably hightrading liquidity, investment capacity and moderate index turnover.

Small-Cap = MSCI USA Small Cap Index: MSCI USA Small Cap Index is designed to measure the performance of the small cap segment of the US equity market. With 1,864 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in the US.

Multi-Factor = MSCI USA Diversified Multiple-Factor Index: MSCI USA Diversified Multiple-Factor Index is based on a traditional market cap weighted parent index, the MSCI USA Index, which includesUS large and mid-cap stocks. The index aims to maximize exposure to four factors –Value, Momentum, Quality and Low Size --while maintaining a risk profile similar to that of the underlying parent index.

Min-Volatility = MSCI USA Minimum Volatility Index: MSCI USA Minimum Volatility Index aims to reflect the performance characteristics of a minimum variance strategy applied to thelarge and mid-cap USA equity universe. The index is calculated by optimizing the MSCI USA Index, its parent index, in USD for the lowest absolute risk (within a given set of constraints). Historically, the index has shown lower beta and volatility characteristics relative to the MSCI USA Index.

MSCI USA = MSCI USA GR USD: which is designed to measure the performance of the large and mid cap segments of the US market. With 622 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

Dalbar Disclosure

Source: “Quantitative Analysis of Investor Behavior, 2022” DALBAR, Inc. www.dalbar.com

Equity benchmark performance and systematic equity investing examples are represented by the Standard & Poor’s 500 Composite Index, an unmanaged index of 500 common stocks generally considered representative of the U.S. stock market. Indexes do not take into account the fees and expenses associated with investing, and individuals cannot invest directly in any index. Past performance cannot guarantee of future results.

Fixed Income benchmark performance are represented by the Bloomberg Barclays Aggregate Bond Index, an unmanaged index of bonds generally considered representative of the bond market.

Inflation is represented by the Consumer Price Index-U.

The Average Asset Allocation Fund Investor is comprised of a universe of funds that invest in a mix of equity and debt securities.

Average equity and average bond investor performance results are calculated using data supplied by the Investment Company Institute. DALBAR is an independent, Boston-based financial research firm. Investor returns are represented by the change in total mutual fund assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions and exchanges for each period.

© Morningstar 2022. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.