As Investors, Millennials Haven’t Had It Easy…

Unlike Gen X and the Baby Boomers, Millennials experienced extremely difficult markets and economic conditions during their formative years, including two major bear markets. During the early stages of their careers, they’ve faced both the housing bubble implosion of 2008 and 2020’s COVID-19 Pandemic, which, they are still grappling with. And they carry a great deal of debt. On average, Millennials have $78,396 in consumer debt[1] and $37,172 in student loan debt[2]. Between seemingly endless market tumult, and potentially insurmountable debt, many Millennials have developed a skeptical view of investing.

In fact, 43% of Millennials have elected not to invest at all[3]. Only 51% of them want to invest for retirement3. In addition to that, those Millennials who do elect to invest, tend to be averse to stocks. Approximately 30% of this age demographic identified “cash”, not stocks, real estate, or even bonds as their favorite investment[4]. Unfortunately, this reluctance to invest may have significant consequences for Millennial’s long-term financial futures.

The pensions that once served as the bedrock for their parents’ retirement plans are disappearing. And because of fundamental changes in our population, and the COVID-19 Pandemic, Social Security's massive trust fund may be unable to pay full benefits as of 2034[5]. As of 2020, the average life expectancy at birth for the total U.S. population was 77.8 years[6]. That’s a long lifespan to sufficiently keep funded. As a matter of necessity, the quality of Millennials’ retirement largely rests on what they do now to save and invest.

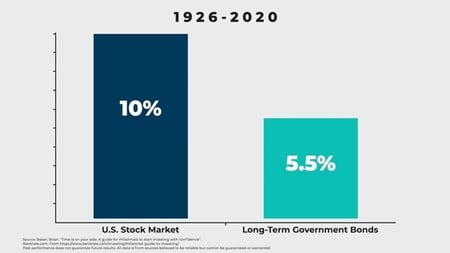

A conservative investment approach could be an expensive mistake. From 1926 – 2020, the U.S. stock market returned roughly 10% annually. Long-term government bonds returned only 5.5% annually[7]. There is just no comparison. Additionally, Not allocating more money to stocks, via mutual funds or ETFs (or directly) could cost Millennials as much as $3 Million in retirement savings[8].

As an investor, time is one of your greatest allies. The sooner you start, the more time your investments have, to potentially grow. But you must be in it, to win it.

Click the video below to learn why Millennials (as well as most Americans) should be investing in the stock market:

[1] Experian, “2019 Consumer Debt Study”,

[2] Debt.org, “Students & Debt”,

[3] Yahoo Finance, “43% of Millennials Aren’t Investing – and That’s a Problem”,

[4] The Balance. Lemke, Tim. “How Millennials Can Invest $10,000”

[5] NPR.org. “A New Report Says The COVID Recession Has Pushed Social Security Up A Year”

[6] U.S. Department of Health and Human Services. Provisional Life Expectancy Estimates for January through June 2020. https://www.cdc.gov/nchs/data/vsrr/VSRR10-508.pdf

[7] Bankrate.com. Time is on your side: A guide for millennials to start investing with confidence. https://www.bankrate.com/investing/millennial-guide-to-investing/

[8] Nerdwallet. O’Shea, Arielle & Lesaffre, Stephane. Avoiding the Stock Market May Cost Millennials $3.3. Million. https://www.nerdwallet.com/blog/investing/avoiding-the-stock-market-may-cost-millennials-3-3-million/

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third-party communications on this site and will not be liable for any such posts.

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the occurrence of which would have the effect of decreasing historical performance results. Actual performance for client accounts will differ from index performance.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization.