Putting the Russia/Ukraine Crisis in Perspective

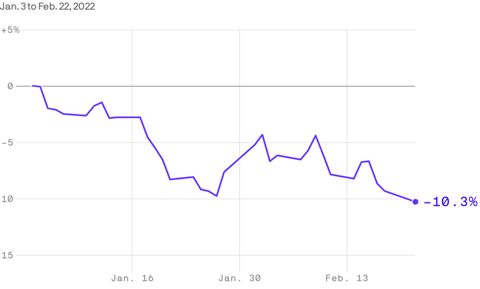

The S&P closed in correction territory Tuesday with all 11 sectors down, as market participants continue to be concerned about inflation, higher interest rates, higher energy prices (brent crude hitting its highest price level in eight years at close to $100 a barrel), and of course Russia's invasion of Ukraine.

S&P 500 Chart

Past performance does not guarantee future results. All data is from sources believed

to be reliable but cannot be guaranteed or warranted.

Couple of items to keep in mind:

- On average, the market typically has a correction roughly every two years (there have been over 36 of them since 1950)

- Energy markets are global. With Germany halting the certification of the Nord Stream 2 pipeline from Russia, expect higher prices in Europe to have an impact on U.S. consumer prices (which were already up 27% from the prior year in January).

- Markets can be sensitive to geopolitical events, but prices quickly adjust to incorporate the impact of these events on economies and companies. Case in point: according to the Peace Research Institute Oslo (PRIO), there were 56 active conflicts recorded in 2020, 8 of which were classified as “wars”…global markets overcome these and a pandemic to finish with strong positive returns.

- Broad based diversification across geographies, investment vehicles, asset classes, risk factors, etc. are the best way in our opinion to build a robust all-weather portfolio that allows investors to stay the course and reap the long-term rewards markets have provided over time.

As adherents of broad diversification in global markets, our clients may have concerns specifically about Russian/Ukrainian exposure in their portfolios. Our portfolios do not have direct exposure to Ukrainian equity or fixed income. Russian exposure is less than 1% across our funds, and models.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization.