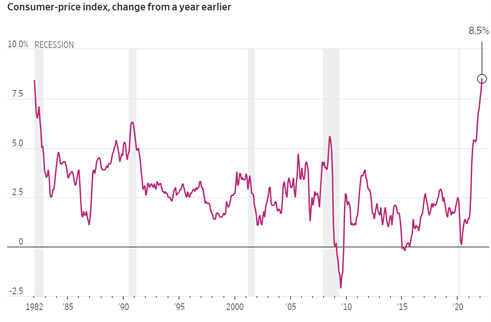

Inflation Hits a Four-Decade High – What This Means for Investors

U.S. inflation has surged to 8.5% in March, up from the 7.9% annual rate in February, which represents a new four-decade high.

The Labor Department announced the consumer-price index (CPI)—which measures a basket of goods and services that the average consumer pays for—rose at its fastest annual pace since December 1981.

The recent rise in prices have been relentless, with six straight months of inflation above 6% (well above the Federal Reserve’s 2% target).

Source: U.S. Labor Department

Source: U.S. Labor Department

Why is this happening?

There are a number of things driving the increase, including:

- The economy – employers have been adding more than 400,000 new jobs every month for 11 straight months, and wages have been rising to attract/retain workers

- Energy prices – crude oil prices have soared since Russia’s invasion of Ukraine

- Food prices – rising rapidly due to weather, supply chain issues, and now the skyrocketing price of fertilizer (also impacted by the Russia/Ukraine conflict)

- Housing prices – housing market has more demand than current supply, causing prices to shoot up to historic highs

How This Could Impact Investors

Federal Reserve officials have indicated they are ready to do what it takes to cool inflation. They have recently signaled a potential to raise rates by a half-percentage point at their meeting early next month, along with an acceleration of reducing their $9 trillion asset portfolio, in what would be the most aggressive effort to curb price pressures since the early 1980’s.

Market participants have responded to the Fed’s comments, causing prices to bounce around for both stock and bond markets. There is plenty of fear that inflationary pressures have gotten away from the Fed, and they will tighten monetary policy to the point that the economy tips in recession, while other market participants argue the strength of the economy gives the Fed enough room to engineer a “soft landing” slowing inflation without impairing the overall economy.

As market participants “vote” with their dollars, either buying or selling, the back and forth will continue to be a source of market volatility. Expect a bumpy ride in the short-term.

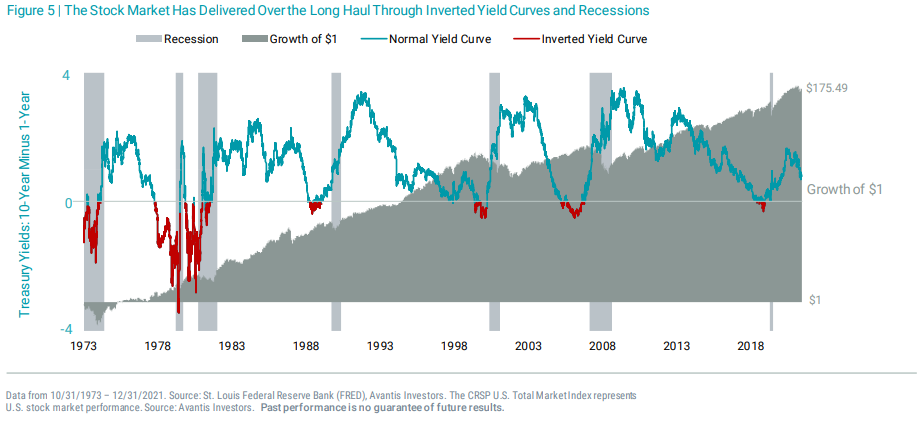

Long-term investors would do well to take a deep breath, and keep in mind the rewards that accrue to investors who have the discipline to stay the course. The chart below shows the growth of a $1 invested in U.S. equities over a turbulent 40 year period that saw stagflation of the 1970’s, inflation and aggressive Fed tightening in the early 1980s, the Tech Bubble, 9/11, the Global Financial Crisis, and a global pandemic.

Key takeaway – the ride for investors is a roller-coaster, it always has been, just don’t let fear make you get off at the wrong time.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.