The Fed Unleashes its Double-Barreled Attack on Inflation

"Inflation is much too high, and we understand the hardship it is causing. We are moving expeditiously to bring it back down." – Jerome Powell, Federal Reserve Chairman

Latest Development

On Wednesday (May 4), after the most recent of its eight regularly scheduled policy meetings, the Federal Open Market Committee announced that they will take aggressive steps to tighten monetary policy. In what is being hailed a “double-barreled” effort, the Fed will:

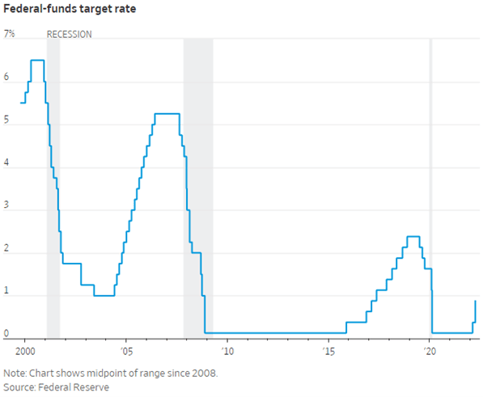

- Raise the benchmark federal-funds half a percentage point, moving the target a range from 0.25% - 0.50% to a range between 0.75% - 1%.

- Rapidly reduce the $9 trillion portfolio of Treasuries and agency mortgage-backed securities on its balance sheet, that it acquired to support the economy during the pandemic-induced downturn.

Why Is The Fed Being So Aggressive?

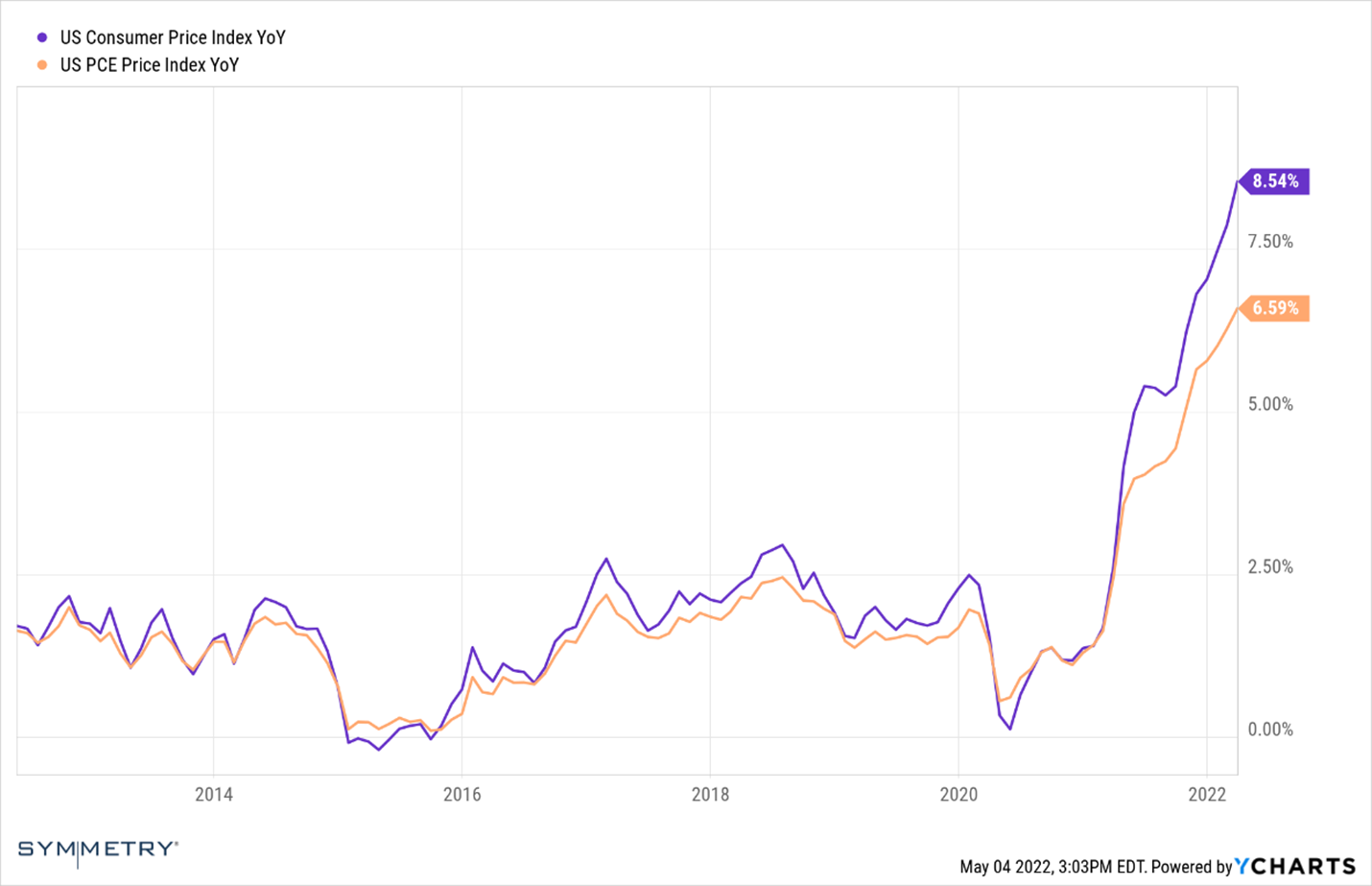

In his comments following the meeting, Chairman Powell indicated that fighting recently soaring inflation has become job number one for Fed (see common measures of inflation spiking in the chart below). A task made more challenging given ongoing upward pressure on prices stemming from rising wages, and supply chain bottlenecks caused by the war in Ukraine and Covid-19 lockdowns in China.

Big Picture

The Fed is taking the type of action not seen in decades to combat the most inflationary environment in the past forty years. Their goal is to find the sweet spot of taming inflation without slowing the economy so much that it tips into recession. The tools available to them are blunt in nature, and market participants will be watching closely with the hope that they have the skill to deftly use them, and a modicum of luck to keep them from going too far.

For long-term investors, however, markets have shown resilience over time in inflationary/deflationary and rising/falling rate environments, so it is best not to let the headlines on this issue drive your behavior.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios. All data is from sources believed to be reliable but cannot be guaranteed or warranted.