-5.png)

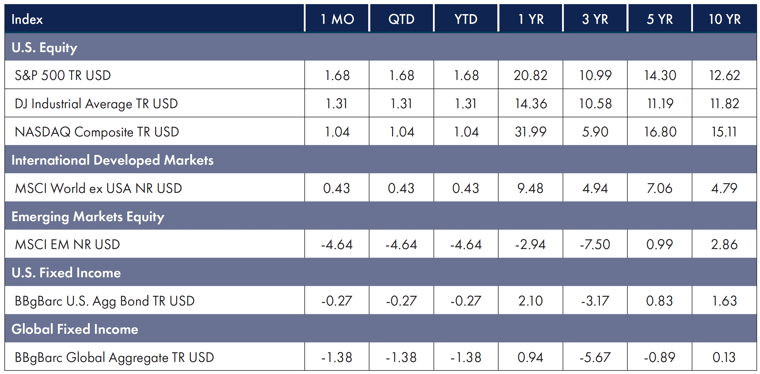

Market Commentary: January 2024

Big Picture

The animal spirits that animated the “everything rally” at the end of 2023 carried over into the new year, and market participants spent much of January positioned to front-run central bank easing. That translated to a string of record-breaking performances for U.S. equities and a surge in demand for fixed-income securities. Even though markets shed some gains after Federal Reserve Chair Jerome Powell hinted there wouldn’t be any immediate rate cuts, the major U.S. equity indices still managed a reasonable 1%+ return for the month.

Returns % as of 1/31/24

Source: Morningstar. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot

Source: Morningstar. Past performance does not guarantee future results. All data is from sources believed to be reliable but cannot

be guaranteed or warranted. Please see disclosure at the end of commentary for limitations to index performance.

Equity

Equity markets were a mixed bag.

- The S&P 500 and DJ Industrial Average hit a series of record highs throughout the month.

- Global stocks were more challenged. International Developed Markets were slightly up while Emerging Markets were down over –4%.

- Communication Services and Information Technology led all sectors, while Real Estate and Consumer Disc. lagged.

- Livestock and Energy led commodities, while Metals continued to post negative performance.1

Fixed Income

As spreads tighten, investors were eager to buy bonds in January and lock in yields before they drop further.

- Blue-chip firms sold a record-setting amount of bonds for the month.

- This was the busiest January for municipal bond sales in almost a decade.

- The Bloomberg US Aggregate bond index, a widely tracked measure of total returns on U.S. fixed income, finished slightly negative.

- International debt followed U.S. markets, though to a greater degree, and the Bloomberg Global Aggregate bond index finished the month down –1.38%.2

Factors

Equity risk factors were a mixed bag for the month. Momentum has gotten off to a hot start for the year, demonstrating significant outperformance across all markets. Size has lagged markets in the United States and International Developed Markets. In the meantime, while negative on an absolute basis, all factors have been relatively positive contributors in Emerging Markets.3

News Impacting Markets

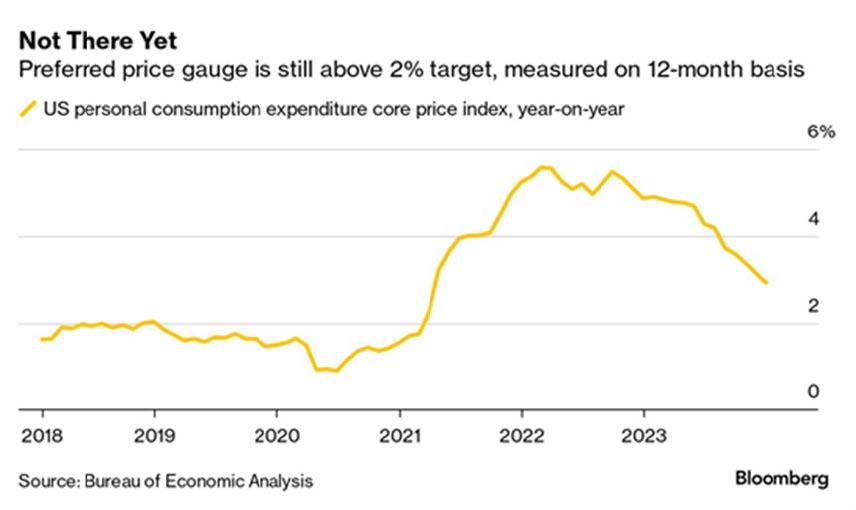

The Economy, Inflation & the Fed

As expected, at its January meeting, the Fed held its benchmark federal funds rate steady between 5.25% and 5.5%. At the post-decision news conference, however, Chair Powell dealt a blow to hopes of a rate cut in March. “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting,” he stated.

The Fed Chair acknowledged the dramatic progress in fighting inflationary pressures in recent months but repeatedly emphasized the need to see “more” data confirming that downward trend.4

Two data points the Fed will be keeping a close eye on are ongoing lower inflation readings (the data has been good here; they want to see more of it) and the labor market. Dramatic softening would cause the Fed to consider rate cuts, but with job growth far outstripping economists’ expectations in January, that prospect doesn’t seem imminent.5

Priced for Perfection

The stock market’s recent run to record highs has been fueled by the “Magnificent Seven”—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Expectations typically play a key role in the price investors are willing to pay for a security, and the stratospheric run these stocks have recently made makes expectations even more pronounced. They have been “priced for perfection.” If they fail to deliver “perfection,” there may be a pullback in price.

Case in point: Microsoft and Alphabet. Microsoft posted revenues of ~$62 billion in its fiscal Q2 ending December 31, 2023, a 17.6% year-over-year increase, which exceeded analyst expectations. That was its best revenue growth in seven quarters, thanks to the release of new AI-enabled Office products. Meanwhile, Alphabet also reported strong results, with total revenue up 13% year-over-year to ~$86 billion.

Yet, despite their success, Alphabet and Microsoft shares declined after the companies’ quarterly reports. Why?

Both firms warned of the high costs of continuing to develop cutting-edge AI products this year. Strong quarterly results were insufficient to persuade investors that their future growth will keep up with the massive investments they plan to make to deliver generative AI.

Microsoft’s shares dropped almost 3%, while Alphabet’s stock dropped almost 7.5% in the immediate aftermath.6

Perfection…missed.

Final Thoughts

In their award-winning book, This Time Is Different: Eight Centuries of Financial Folly, economists Carmen Reinhart and Kenneth Rogoff systematically reviewed more than 250 financial crises in 66 countries over 800 years, looking for differences and similarities. One of the common threads in all these times and places was that people thought, “This time is different,” and the old rules no longer applied.

Centuries of research have shown us that the old rules still apply—risk and reward are intrinsically related, price matters, diversification is a prudent strategy for risk management, and patience is the key to investing success.

It’s been an unusual few years, and markets have gyrated. Yet we encourage you to refrain from thinking, “This time is different,” and stick with the time-tested investment approaches that have served investors well.

1 Morningstar Direct, January 31, 2024

2 Morningstar Direct, January 31, 2024

3 Morningstar Direct as of January 31, 2024

4 Authers, J. “A Fed Rate Cut in March Is Now Pretty, Pretty Unlikely,” Bloomberg.com, February 1, 2024. https://www.bloomberg.com/opinion/articles/2024-02-01/powell-says-a-fed-interest-rate-cut-in-march-is-unlikely

5 Goldfarb, S. “Hiring Accelerated With 353,000 Jobs Added in January,” Wall Street Journal, February 2, 2024. https://www.wsj.com/economy/jobs/jobs-report-january-today-unemployment-economy-4f3a772e

6 “Microsoft’s and Google’s AI Plans Clouded By Concerns of Rising Costs” (n.d.), Financial Times. https://www.ft.com/content/a062df1d-aaf5-4604-8f97-4444170482f2

The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration with the SEC or any state securities authority does not imply a certain level of skill or training. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. Please note the material is provided for educational and background use only. Moreover, you should not assume that any discussion or information contained in this material serves as the receipt of, or as a substitute for, personalized investment advice. Diversification seeks to improve performance by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market. Past performance does not guarantee future results.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization. Dow Jones Industrial Average (DJIA) Is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The Nasdaq Composite Index (NASDAQ) measures all Nasdaq domestic and international based common-type stocks listed on The Nasdaq Stock Market and includes over 2,500 companies. MSCI World Ex USA GR USD Index captures large and mid-cap representation across 22 of 23 developed markets countries, excluding the U.S. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets (as defined by MSCI). The index consists of the 25 emerging market country indexes. Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed-income securities in the United States—including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Bloomberg Global Aggregate (USD Hedged) Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers. Index is USD hedged. Stock returns represented by Fama/French Total U.S. Market Research Index, provided by Ken French and available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. This value-weighed U.S. market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted U.S. market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

© Morningstar 2023. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted, or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.