Q1 2022 In Review

Markets reflected a host of investor concerns during the first quarter of 2022. Over the past four decades, U.S. investors have experienced declining interest rates, benign inflation, globalization of trade, and relative stability among the world’s superpowers. During the first quarter of 2022 those trends were upended as markets were faced with rising interest rates, spiking inflation, ongoing supply-chain snarls, and a land-war in Europe. Stocks and bonds alike slumped.

By the end of the quarter, equities markets had battled back from being down in correction-to-bear-market territory to finish down 4-8% (depending on the index). In fixed income performance, U.S. bonds suffered the biggest quarterly loss since 1980, and global bonds kept pace.

Key issues weighing on markets

- Russia’s invasion of Ukraine - Russia invaded its neighbor Ukraine. Western nations responded with targeted sanctions, causing collateral damage in the form of exacerbated supply-chain disruptions and by driving up prices of key commodities.

- Labor Market Recovery – S. employers added 431,000 jobs in March, extending the streak of 11 straight months of job gains above 400,000, the longest such stretch of growth in records dating back to 1939.

- Inflation - reached a new 40-year peak in February, buoyed by a tight labor market, ongoing supply problems and strong U.S. consumer demand.

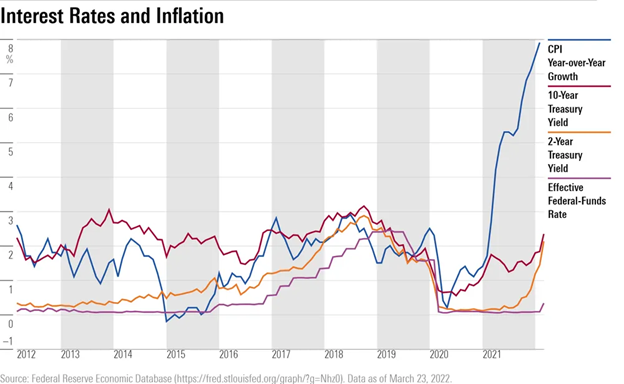

- Interest Rates – The Fed responded to inflationary pressures by raising its benchmark short-term rate by a quarter percentage point and have indicated a series of rate rises this year are anticipated.

- Yield Curve Inversion - short-term treasury rates (2 yr) were edging higher than the long-term treasury rates (10 yr), which has historically been viewed as a good predictor of a recession (an inverted curve has preceded 10 out of the last 13 recessions).

Bottom Line

Markets can be sensitive to changes in interest rates, inflationary pressures, and geopolitical events, but prices quickly adjust to incorporate the impact of these events on economies and companies. Broad-based diversification across geographies, investment vehicles, asset classes, risk factors, etc. are the best way to build a robust all-weather portfolio that allows investors to stay the course during the more turbulent periods and reap the long-term rewards markets have provided over time.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.