The Fed Raises Rates (Again)…Now What?

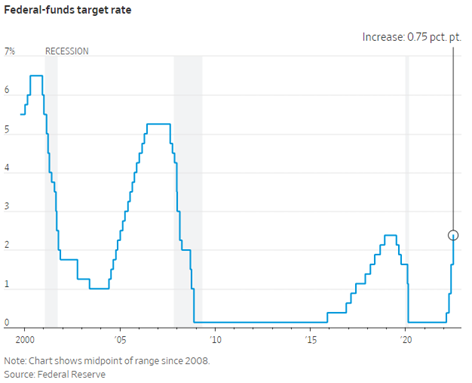

As expected, after the conclusion of the July Federal Reserve Open Market Committee two-day meeting, the Fed announced that they would raise interest rates by three-quarters of a percentage point for the second straight meeting. This will bring their benchmark rate to a range between 2.25% and 2.5%.

Big Picture

The 75-basis-point moves in June and July were substantial rate increases and part of a campaign meant to slow the economy and get inflation under control. In a policy statement released after the meeting, officials acknowledged signs of slower economic activity since they met and raised rates last month. However, Chair Jerome Powell has made clear he does not believe the U.S. is in a recession, citing ongoing strength in the labor market. He isn't ready to relent on rate increases until actual month-to-month inflation has fallen and stays low.

Why it matters

In general, rate increases tend to slow the economy and cool inflationary pressures by raising borrowing costs, which restrains investment, hiring, and spending. However, higher rates can’t fix supply-chain bottlenecks or increase oil production or refining capacity, and more expensive borrowing threatens to worsen some of those constraints by deterring new investment.

Bottom Line

Given the ambiguity in recent economic data, the Chairman indicated that the Fed would let the data determine what happens next. While he shared an expectation for more rate increases later this year, he acknowledged that “further surprises could be in store,” and nothing is set in stone. Like the rest of us, he will just have to wait and see what developments tomorrow holds.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission (SEC). The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. A copy of Symmetry's current written disclosure brochure filed with the SEC which discusses among other things, Symmetry’s business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov.