What (if anything) Should We Make of Evergrande?

Chinese construction giant Evergrande is flirting with default on its $300 billion of liabilities, which would be one of the largest in the history of the world. Predictably, this possibility has injected volatility across global markets.

While Evergrande debt has always carried a low junk rating, and investors were acutely aware that they were taking a big risk, the fears of a potential for spillover effect of an Asian-contagion to markets comes at a time when market participants were already pulling back on risk exposures. The soft August jobs report has folks nervously watching the Fed meeting this week and the economic projections that accompany it (inflation forecasts, potential taper timing, plot-dot timing of future rate hikes, etc.).

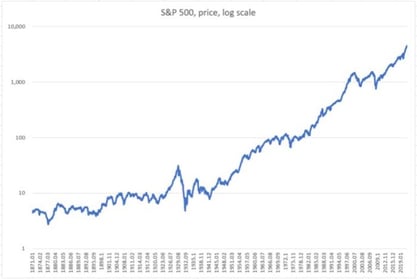

With risk assets at historically expensive levels, markets are ripe for a pull-back, and any of these could serve as catalyst for sentiment to turn…or not...markets could just as easily melt up from here for a time. Either way, for investors with a long-term orientation the chart below offers some perspective:

This is the S&P 500 price for the last 150 years, on a log scale (the data comes from Robert Shiller at Yale). The period above encompasses world wars, market bubbles & crashes, inflation, stagflation, rising and falling rate environments, and so on. The ride is a bumpy one, and investors can get caught up in the shorter term ups and downs, but equities markets have been an unbelievably powerful wealth building machine…the catch is you have to own them over time to reap the rewards. We know that being broadly diversified (across geographies and risk factors) puts the odds in your favor, but we believe being disciplined and patient are the true keys to investing success.

Regardless of how it eventually plays out, Evergrande will fade into memory, the Fed will eventually taper, rates will rise/fall/rise again, and life will go on.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.