The “What, Why & How” of Direct Indexing - Part I

Part I: What is Direct Indexing

You may have recently noticed well known financial firms touting the next great thing…Direct or Personalized Indexing. If you’re not sure what that means, and you find yourself wondering if you’re somehow missing the boat, you are not alone. Good news…we can help…read on.

What’s an Index?

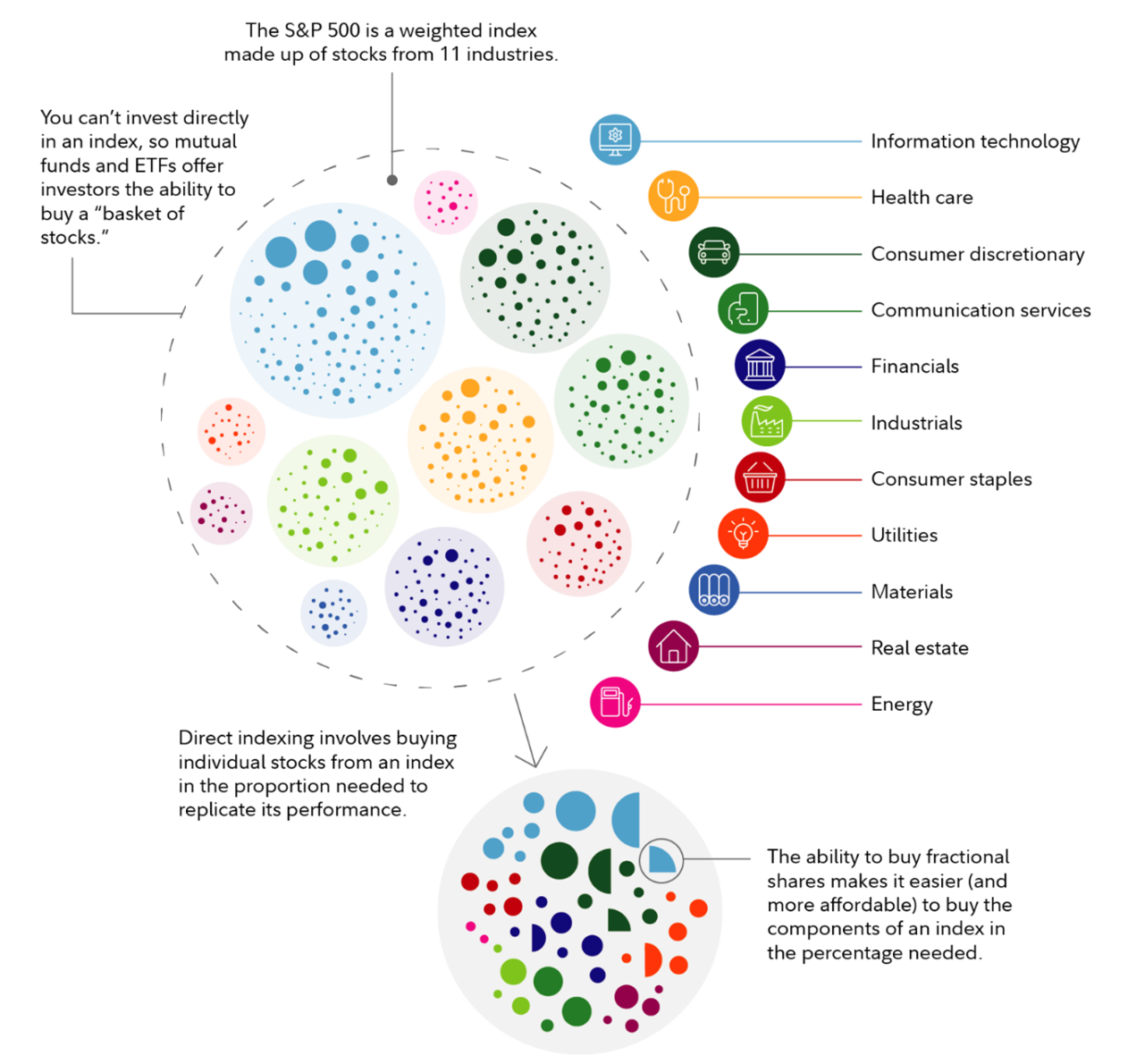

Indexes are simply baskets or collections of investments like stocks or bonds that have been grouped together. Take the S&P 500 Index for example, it consists of stocks from 500 U.S. companies, that represent approximately 80% of the total assets of the U.S. stock market (but not all U.S. companies, though there is an index for that too!). There are many mutual funds and exchange traded funds (ETFs) that allow investors to track an index, like the S&P 500, by holding most, if not all, of the securities in the index.

Index funds have become a popular way to investment, they give you access to hundreds if not thousands of securities, they’re often inexpensive relative to other similar investment vehicles, and are simple to use building blocks for portfolios.

What Does It Mean to Own An Index Directly?

When you own shares of an index fund, you have exposure to the stocks or bonds in the in same proportion as the index, but you own them indirectly. This means that what you actually own are shares of mutual funds and/or ETFs which are “commingled vehicles.” Because it can be expensive for individual investors to try and buy all 500 stocks that it would take to track the S&P 500, mutual funds and ETFs have been an excellent solution to allow investors to pool their money with other investors so together they can buy hundreds or even thousands of securities.

However, everyone who buys that mutual fund or ETF gets the same combination of securities. You can’t pick and choose to buy or sell specific underlying securities (say you really want to own Apple, but really don’t want to own Exxon). You are stuck with the index as-is (or as the fund manager is mandated to track it by prospectus). In other words, one size fits all. It’s a fine solution for most investors, but some may find that they want more flexibility. They may want to exclude—or include –certain companies to make their portfolio better align with their values. Or they may have legal or professional requirements to exclude certain stocks or sectors. And they might want to better manage potential taxes. Enter Direct Indexing.

Source: Fidelity Investments

Direct indexing means you are investing in the individual securities, which allows investors to directly own all or a customized assortment of the securities in an index. This gives the investor the same type of holdings that comprise the index, but also gives them the opportunity to build a customized version, and tailor it to the individual’s specific goals, values, preferences, or circumstances. For instance, an investor can exclude certain securities (like Exxon) or increase their exposure to others (like Apple), focus on limiting tax exposure, or tilt the index towards certain risk factors.

In other words, direct indexing offers powerful flexibility for investors that are seeking a way to capturing market-like returns with an index that they can build and control. But not all direct indexing solutions are created equal…

Up next: “Why Direct Indexing Might Make Sense For You”

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.