Though rates of COVID infection remain high in many parts of the U.S., many Americans are looking forward to a summer of more traditional pursuits, such as vacation trips, amusement parks, ice cream outings, etc. For businesses that are typically seasonal in nature, this should be a welcome opportunity to get back to some approximation of normal. Unfortunately, things are not shaping up that way.

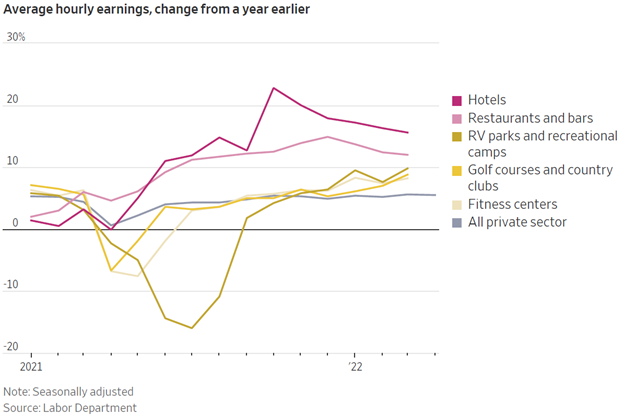

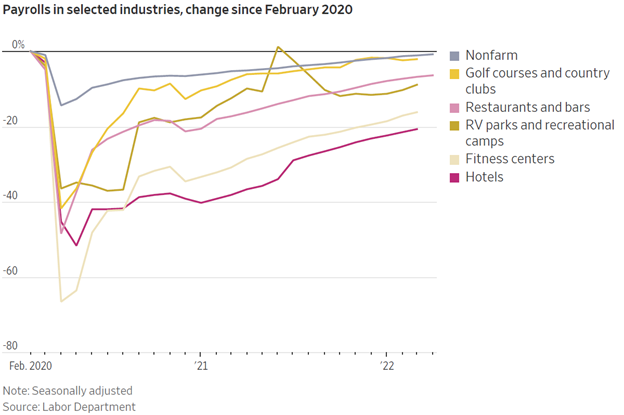

A chronic labor shortage is causing companies to make tough decisions. Across the country we are seeing announcements of facilities not being able to open or being forced to open with shortened service hours. As the charts below show, consumer demand is high and wages are being pushed up, but with almost two open jobs for every job seeker, there simply are not enough drivers, waiters, cooks, lifeguards, etc. to adequately staff these locations.

The immediate impact for most of us will be felt in the form of limited services, waiting lists and higher prices. For investors, it could mean that certain parts of the market will continue to be challenged (airlines, hotels, tourism-related businesses), which will be an ongoing source of volatility.

For long-term broadly diversified investors, these types of shorter-term challenges get reflected in prices and tend not to be a major stumbling block for performance over time. Don’t let market gyrations get you hot under the collar and try to make the most of the summer! And don’t forget your sunscreen!

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission (SEC). The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.