The “What, Why & How” of Direct Indexing - Part II

Part II: Why Direct Indexing Might Make Sense For You

In our previous post, we explored the rise of direct or personalized indexing and identified how investors who take that path are signing up to directly own the underlying shares of securities that approximate, or fully comprise an index. With a universe of low-cost mutual funds and/or exchange traded funds (ETFs) that track indexes, one might reasonably ask: what is the benefit of Direct Indexing relative to the many other options available?

The true benefit of Direct Indexing for an individual investor comes in the form of enhanced customization, particularly when it comes to improving outcomes in leveraging tax efficiencies.

Tax Management

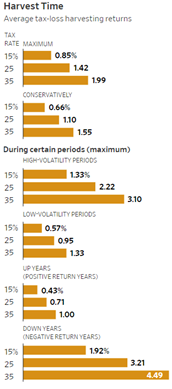

Direct indexing’s most quantifiable value is tax optimization and the resultant tax savings. Research suggests that investors can realize higher returns by selling losing securities and using (or “harvesting”) the losses to offset the capital-gains tax liability from winning securities.

Tax-loss harvesting is not a new concept. For years institutions and wealthy investors have engaged in selling some stocks or assets that have fallen in value and using the losses to help offset capital-gains tax liability, reducing the overall tax bill. However, historically this has been an inefficient process that has involved finding and selling these positions manually. Further, the benefit was quite sensitive to when the harvesting process occurred (example: doing it at the end of the year presumes that specific holdings were down in 4thquarter and excludes temporary losses that might have occurred earlier in the year). Thanks to advances in technology, this process can now be executed efficiently on an ongoing basis, maximizing the overall benefit (as you can see from the chart below its estimated this can add anywhere from .40% to over 4% per year to overall returns depending on the market environment and individual’s tax situation).

Source: Derek Horstmeyer “Just How Valuable is Tax-Loss Harvesting” Wall Street Journal, 4 Dec 2021

Source: Derek Horstmeyer “Just How Valuable is Tax-Loss Harvesting” Wall Street Journal, 4 Dec 2021

Another tax-efficient feature of direct indexing involves individual securities holdings. For those investors who already have a potential tax-liability from a long-term holding with a low cost basis, or significant wealth in the form of equity compensation from a publicly traded company, direct indexing can be a way to facilitate a plan to slowly exit a highly appreciated or concentrated equity position.

For those investors who have significant assets in taxable accounts, or are tax-sensitive in general, direct indexing can be a solution worth exploring.

Don't forget to checkout Part I and Part III.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

Symmetry Partners, LLC is an investment adviser in Glastonbury,CT. Symmetry Partners, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. [FIRM NAME] only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Symmetry's current written disclosure brochure filed with the SEC which discusses among other things, Symmetry’s business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov.