The “What, Why & How” of Direct Indexing - Part III

Part III: Values Investing & Taxes

In previous posts, we have identified the overwhelming benefit of direct indexing for an individual investor is enhanced customization. This can be realized in the form of leveraging tax efficiencies, but can also be an attractive solution for investors who want to express personal preferences or values such as adopting ESG strategies or pursue specific investment opportunities like Factor tilts.

Direct Indexing & Values-Based Investing

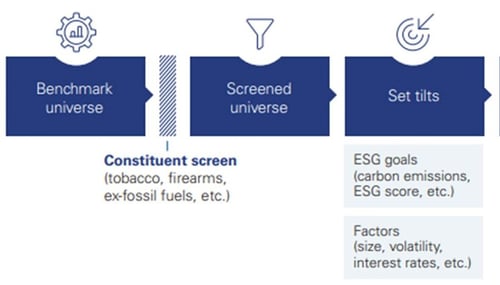

Direct indexing can be an excellent solution for those who wish to express specific values, such as incorporating environmental, social, and governance (ESG), or socially responsible investing (SRI). For example, an investor can adopt a strategy that either screens out certain securities (fossil-fuel producers, big tobacco, gun manufacturers, etc.), or overweight companies that have adopted certain standards and practices (diversity focused hiring, beneficial corporate ethics, social change).

Direct indexing can also be utilized to help facilitate charitable giving. In lieu of identifying and harvesting losses from stocks that have declined in value, an investor can focus instead on identifying highly appreciated securities and harvest those to donate to a specific charity or donor-advised fund, where the investor might be able to direct funds to multiple charities.

Direct Indexing & Factor-Tilts

For investors who have a desire to integrate high conviction strategies in their portfolios, direct indexing can also play a role. For instance, tilting an index to overweight specific risk factors such as value, momentum or minimum volatility with the potential to capture the long-term benefits identified by academic research, can be accomplished while tailoring those exposures to the investor’s specific tax and values preferences.

Source: Vanguard

Ultimately, direct indexing offers investors greater flexibility to choose specific strategies that can enhance their tax management, or better express their values and preferences.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice, recommendation or offer of any security for sale.. Symmetry Partners does not approve or endorse any third party communications on this site and will not be liable for any such posts.

Investing involves risk, including the loss of some or all of your principal. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission (SEC). The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. A copy of Symmetry's current written disclosure brochure filed with the SEC which discusses among other things, Symmetry’s business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov.