Since the summer of 2020, after a brief pandemic-driven bear market, the stock market experienced a historic rebound. From date to date, the S&P 500 experienced a 1-year return of +45.83%. Those investors, who chose to stay in the market, had the opportunity to experience the benefits of this recovery.

But as history has repeatedly shown us, both bull and bear markets are inevitable. Since 1932, declines of 20% or more (the definition of a bear market) have happened an average of every 56 months1.

When you try to time the onset of bear markets, you must be right twice – both when you get out, and, when you get back in. This is almost impossible to do consistently and successfully, and inevitably means missing out on potential growth.

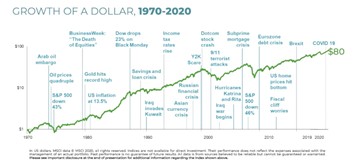

Instead, prepare for a bear market, the same way you would prepare for a bull market. Identify the right level of risk you can tolerate, and don’t try to outguess the market. Remember, markets have historically rewarded investors for staying invested. As the chart below shows, from 1970 – 2020, the U.S. dollar grew from $1 to $80 despite numerous historical events that briefly rocked markets.

In keeping with Symmetry’s investment philosophy, we believe that a globally diversified, factor-based portfolio, is the most effective way to maintain the long-term success of investors’ portfolios.

Click the video below to learn why (and how) you should prepare for ever-changing markets.

Symmetry Partners, LLC, provides this communication on this site as a matter of general information. Information contained herein, including data or statistics quoted, are from sources believed to be reliable but cannot be guaranteed or warranted. Nothing on this site represents a recommendation of any particular security, strategy, or investment product. The opinions of the author are subject to change without notice. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions. All content on this site is for educational purposes and should not be considered investment advice or an offer of any security for sale. Please be advised that Symmetry Partners does not provide tax or legal advice and nothing either stated or implied here on this site should be inferred as providing such advice. Symmetry Partners does not approve or endorse any third-party communications on this site and will not be liable for any such posts.

1 S&P Dow Jones Indices

Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the occurrence of which would have the effect of decreasing historical performance results. Actual performance for client accounts will differ from index performance.

S&P 500 Index represents the 500 leading U.S. companies, approximately 80% of the total U.S. market capitalization.